CalCoolio

počítejte, modelujte, kalkulujte, investujte

CalCoolio je unikátní finanční aplikace.

Pomáhá při správném finančním rozhodování. Provádí velmi složité výpočty a přitom je velice snadné v použití.

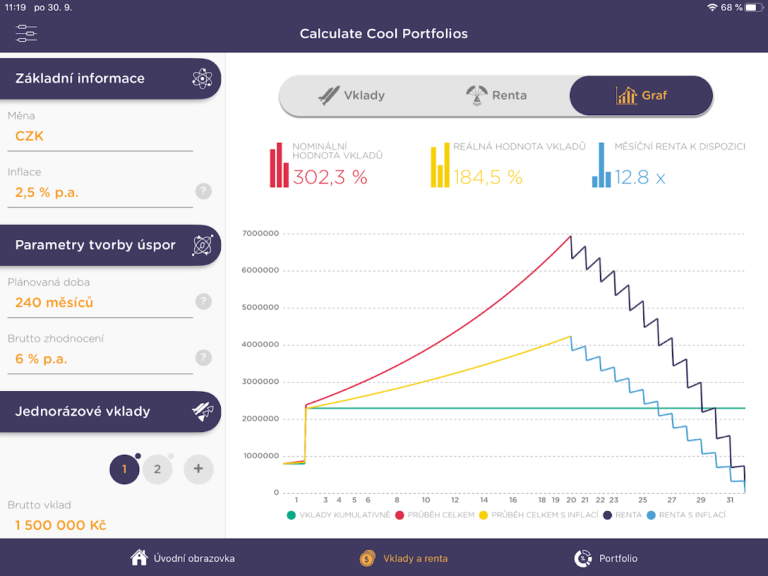

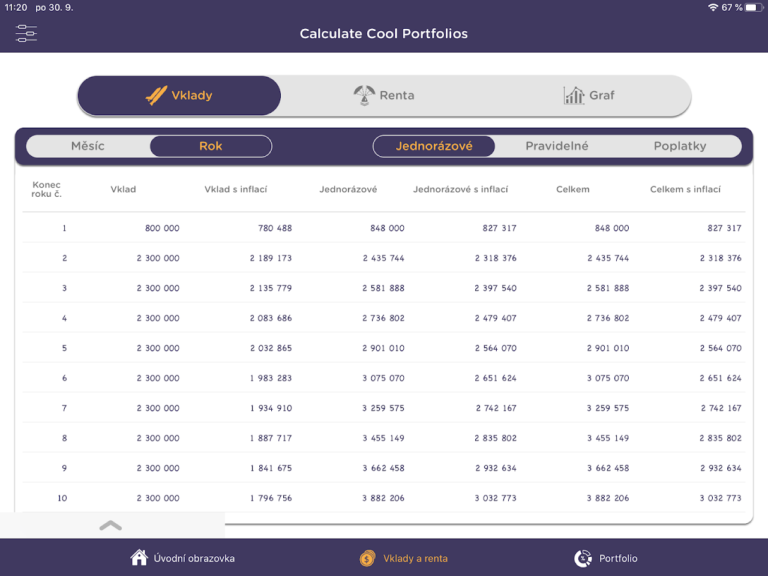

Finance pod kontrolou

CalCoolio pomáhá kontrolovat zdravou strukturu úložek a investic. I její malá změna realizovaná dnes, může ovlivnit finanční jistotu v budoucnosti. Díky CalCooliu přesně víte, co Vás v budoucnu s Vašimi osobními financemi čeká.

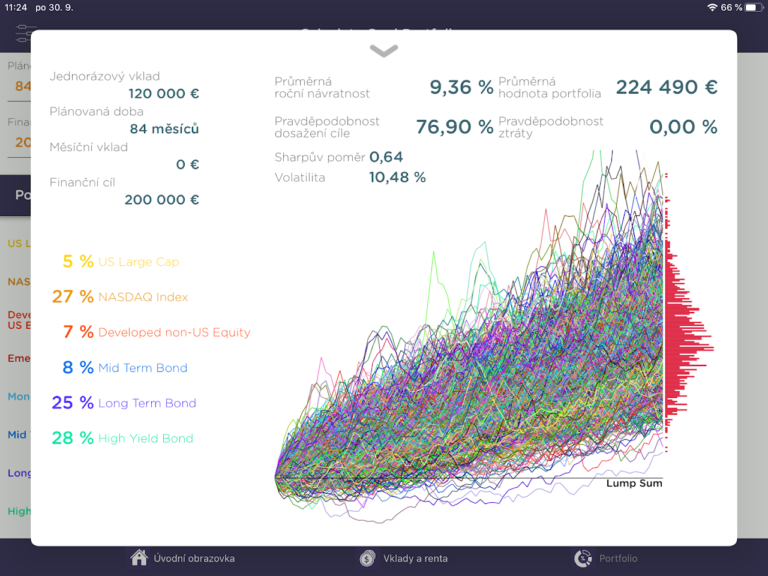

A co vaše portfolio?

Zjistěte, jaký pohled má CalCoolio na reálnost zhodnocení konkrétního portfolia. Vložte použité investiční nástroje dle strategické alokace a nechte CalCoolio namodelovat, jestli jsou vaše cíle reálné.

Snadný v používání

Nepotřebujete hluboké znalosti finanční matematiky. Jednoduše zadejte výši vkladů, zhodnocení, investiční horizont, výši požadované renty a případnou valorizaci a inflaci. Ihned uvidíte, zda výsledek odpovídá vašemu očekávání.

Tohle sami nezkalkulujete

CalCoolio za vás provede 1000** simulací možného vývoje portfolia. Využívá kombinaci statistických metod (Monte Carlo a licencovaný algoritmus

P. Kohouta) a historických dat. Díky tomu se dozvíte reálnou pravděpodobnost splnění vámi definovaného cíle portoflia.

CalCoolio vzniklo díky týmu zkušených odborníků s více

než 15 roky praxe a zkušeností v oboru financí a IT.

Na tvorbě se podílel významný český ekonom a publicista

Pavel Kohout. Je autorem licencovaného algoritmu, který CalCoolio používá pro predikci možného vývoje aktiv.